textile testing

The shadow of China's textile and apparel exports under the trade war

by:GESTER Instruments

2021-06-20

In the first quarter of this year, China's exports to the United States accounted for 16.7% of total textile and apparel exports, an increase of 5.7% year-on-year. From the perspective of export structure, clothing exports are the mainstay, and textile exports are supplemented. In the first quarter, clothing exports accounted for 70.7% and textile exports accounted for 29.3%. China and the United States have a huge trade surplus in textile and apparel trade. In the first quarter, China's textile and apparel trade volume was 293.15 billion U.S. dollars, of which exports were 9.61 billion U.S. dollars and imports were 180 million U.S. dollars. The cumulative trade surplus was 9.43 billion U.S. dollars. The Sino-US trade friction is a hot spot that enterprises pay close attention to at this session of the Canton Fair. At present, textile and apparel products are not in the first round of additional tariffs, and the second round of the lists issued by China and the United States all show textile industry-related products. If trade frictions continue to escalate, the textile industry may be affected to a certain extent in the second half of the year. According to data from the US Department of Commerce, from January to February 2018, the top four exporters of textiles and apparel to the US were China, Vietnam, India, and Bangladesh, accounting for 35.8%, 10.9%, 6.9%, and 5%, respectively. At present, China still has an absolute advantage. As the second largest import market for textiles and apparel in the United States, Vietnam is most likely to accept the transfer of orders due to its relatively complete industrial facilities, low production costs, and abundant labor. The Sino-US trade friction will enable Vietnam to occupy favorable conditions and snatch orders from China for textile and apparel exports to the United States. This is a severe challenge for Chinese textile and apparel companies. Most exhibitors believe that, taking into account the interests of domestic buyers in the United States, the United States will not add textiles and clothing to the list of additional tariffs. The U.S. textile industry has already shrunk severely. The blow to Chinese textile imports has no direct help to the U.S. manufacturing industry. Moreover, as the country with the most complete textile and apparel industry chain, no country in the world can compete with it. In addition, as the global deployment of China's textile industry accelerates, many Chinese companies have deployed in Southeast Asian countries such as Vietnam in recent years. Even if the United States imposes taxes on imports of Chinese textiles, the impact on such companies will be limited. At present, judging from the easing of the Sino-US trade friction atmosphere, as the business negotiations between China and the United States begin, the trade war is not expected to continue to expand. After all, Trump is also under tremendous pressure in the United States. The tariff trade war of China seems to be able to protect domestic products in the United States and increase employment opportunities. However, in terms of international supply chains, markets and costs, the United States has closed its doors to prevent foreign products from entering and also prevented the passage of its own products to other countries. Tariff trade is mutual, and the United States cannot reduce its harm to itself. In this regard, it seems that the Sino-US trade post will not continue to intensify. At present, the market is generally worried about the uncertain trend of China's textile and apparel industry in the second half of the year, and it is also predicting the solution to this Sino-US trade friction. The United States cannot lose the Chinese market, nor can China lose the American market. If you look at the trading post with this attitude, you can grasp the overall situation. Sino-US textile trade frictions have a long history. They did not stop the development of China's textile industry at the most difficult time, but accelerated the upgrading of China's textile industry. In the face of Sino-US trade frictions, companies should accelerate their transformation and upgrading, strengthen themselves, be aware of major trends, and enhance their ability to resist risks.

As we have known for quite some time, the success of GESTER in the future will depend greatly on our ability to strike a balance between valuable human insight and interaction with technology.

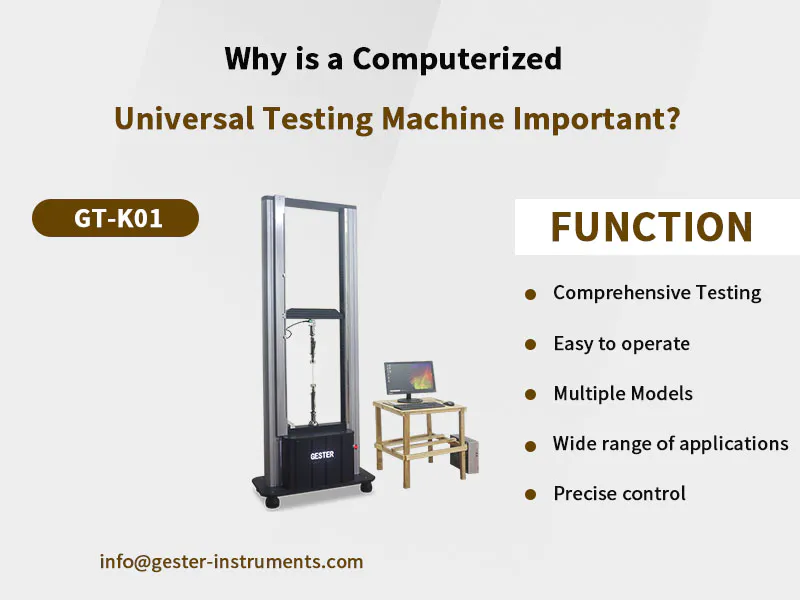

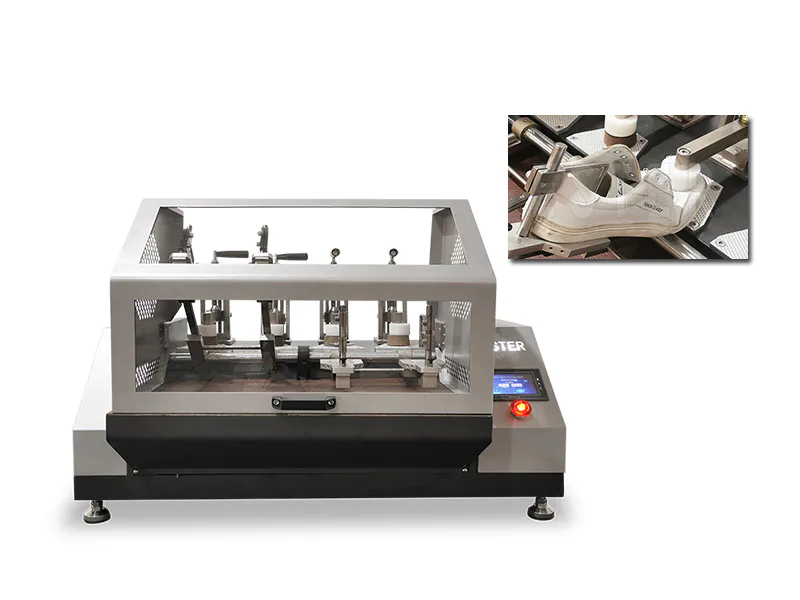

is making its name in professional tensile tester manufacturers all over the world, and with GESTER International Co.,Limited taking great care to make an excellent product & actively involved in keeping the industry well-regulated, it's a product that should make its way into your tensile tester manufacturers.

textile testing equipment is sold in oversees market and has high reputation. Besides, our products are sold with reasonable prices.

There is growing awareness about the health benefits of among the consumers resulting in its increasing popularity.

Along the way, GESTER International Co.,Limited will face a wide range of challenges. The most successful will show our resolve by working through the challenges and finding ways to improve and grow.

As we have known for quite some time, the success of GESTER in the future will depend greatly on our ability to strike a balance between valuable human insight and interaction with technology.

is making its name in professional tensile tester manufacturers all over the world, and with GESTER International Co.,Limited taking great care to make an excellent product & actively involved in keeping the industry well-regulated, it's a product that should make its way into your tensile tester manufacturers.

textile testing equipment is sold in oversees market and has high reputation. Besides, our products are sold with reasonable prices.

There is growing awareness about the health benefits of among the consumers resulting in its increasing popularity.

Along the way, GESTER International Co.,Limited will face a wide range of challenges. The most successful will show our resolve by working through the challenges and finding ways to improve and grow.

Custom message