textile testing

There is no need to worry too much about the prospect of Sino-US trade

by:GESTER Instruments

2022-08-24

The United States announced that starting from September 24, it will impose a 10% tariff on US$200 billion of products from China until the end of the year, and the tax rate will rise to 25% from next year. At the same time, it threatened that if China retaliates, it will further expand“tax base”. However, under the leadership of infrastructure stocks, the Chinese stock market has been booming across the board, and there is no panic. Why is this? The Sino-US trade friction has attracted worldwide attention, and many people are worried about the Chinese economy. While this sentiment is expected and not unfounded, it turns out that being overly pessimistic is entirely unnecessary. Because the Sino-US trade friction has both negative and positive factors. If we make good use of the positive factors, in the long run, it will promote the development of China's economy with higher quality. In fact, in order to keep the economy stable and improving and prevent risks, China has adopted a series of reform measures, especially in the case of sudden changes or uncertainties in the external market, through policy adjustment and comprehensive deepening of reform and opening up, more Focusing on solving the bottlenecks that restrict its own economic and social development will effectively stimulate domestic demand and endogenous power. It is expected that the reform will be intensified in the future, and everyone will benefit from this reform. From a recent point of view, the People's Bank of China continued to invest in the medium-term lending facility (MLF) in the market in September. This Monday, it expanded the MLF operation to 265 billion yuan, exceeding market expectations and releasing policy warmth. On the day the U.S. $200 billion tariff boots landed, the National Development and Reform Commission held a meeting to emphasize the need to make up for the shortcomings of infrastructure, prompting Chinese infrastructure stocks to lead the rise on Tuesday, which made the policy support expectations continue to heat up. On the same day, the entire stock market, led by infrastructure stocks, went red across the board. Both the Shanghai Composite and Shenzhen Component Index closed with the biggest gains not seen in at least the past three weeks. On Wednesday, the Shanghai and Shenzhen stock markets continued to rise, with the three major indexes all rising more than 1%. Analysts from research firm FXTM also pointed out that China's adjustment of its domestic policies to deal with the huge US tariffs has achieved initial results. After several rounds of negotiations, easing, and escalation of the Sino-US trade friction, the Chinese market's expectations for external pressure have basically stabilized, and the focus is now gradually turning to the implementation of China's domestic policies to deal with external pressure. One of the main reasons. In addition, from the perspective of the global exchange rate market, China's series of remarks will also help the RMB stabilize. Taking the U.S. announcement to impose additional tariffs on $200 billion in products from China as an example, the global market rose, and investors basically ignored the latest escalation of Sino-U.S. trade frictions. On the one hand, the U.S. imposed a 10% tariff on $200 billion of Chinese imports, instead of the expected 25%, which also brought some relief to investors. There was some optimism that the two sides were back at the negotiating table to resolve the protracted trade dispute. On the other hand, China's economic volume is already very large. Although the Sino-US trade friction has an impact on the Chinese economy, it will not hurt the bones. In the foreseeable future, China will still be the engine of world economic growth. There is no doubt that , Sino-US trade friction will accelerate the process of China's reform and opening up, and the positive impact on China's economy may be greater than the negative impact. It is true that the future impact of the Sino-US trade friction on the relationship between the two countries depends on whether the two sides can manage their differences and eliminate misunderstandings and prejudices. If they all show open-mindedness and can be honest with each other, there is no obstacle that cannot be overcome. If any country wants to become a powerful country in the true sense and convince the whole world, it must have the broad-mindedness that a big country should have, and must adhere to correct values and codes of conduct, otherwise it may be betrayed. From the perspective of China and the United States, cooperation will benefit both, while confrontation will hurt both. There is no need to hurt each other. Therefore, there is reason to believe that the cooperation between the two sides will still be the mainstream in the future, the difficulties are only temporary, and there is no need to worry too much about the prospects of Sino-US trade. The purpose of the US tariff stick is not to provoke a trade war with China. Its substantive purpose is to pressure the Chinese government to make concessions and compromises, so as to win bargaining chips. Therefore, short-term worries in the market are inevitable, but from a long-term perspective, China's trade situation is bound to be positive.

GESTER Instruments allocates customer service resources to the platform where their customers are most vocal.

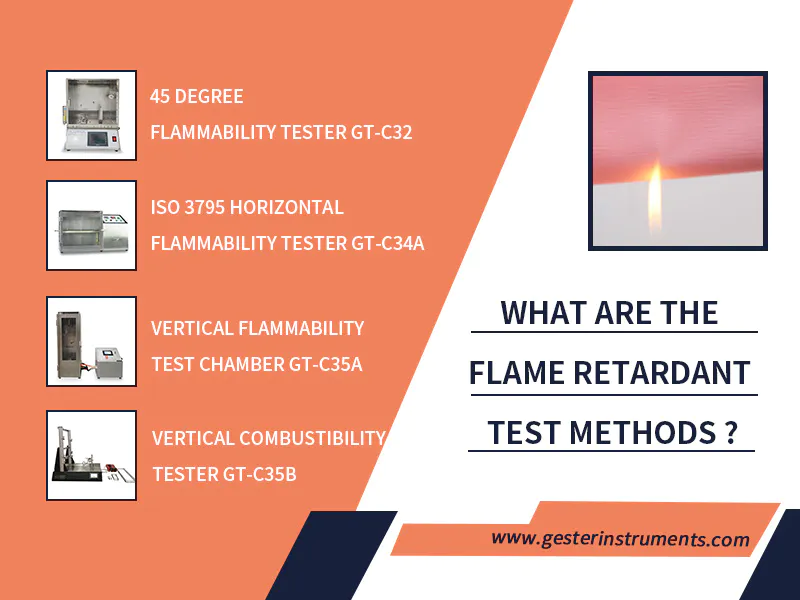

You get a wide variety of security, durability and manageability options across textile testing equipment. Here’s a link of the brand GESTER Instruments.

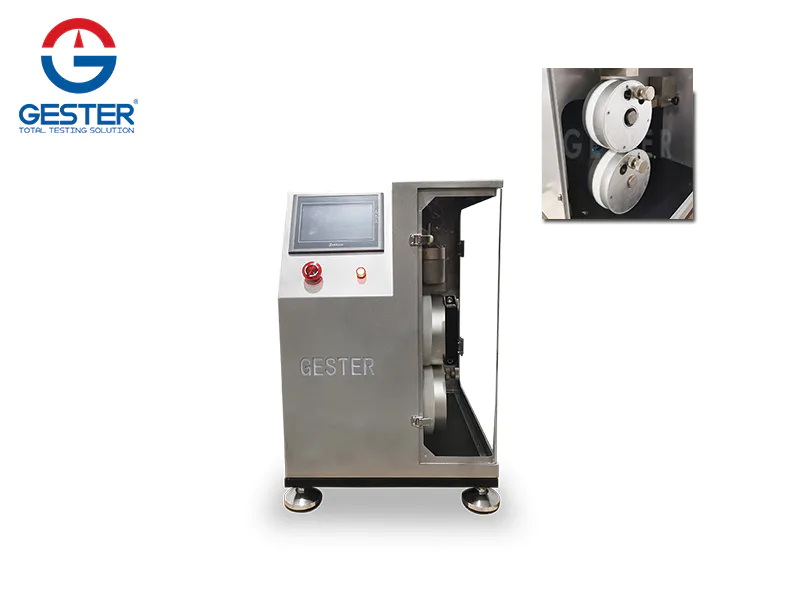

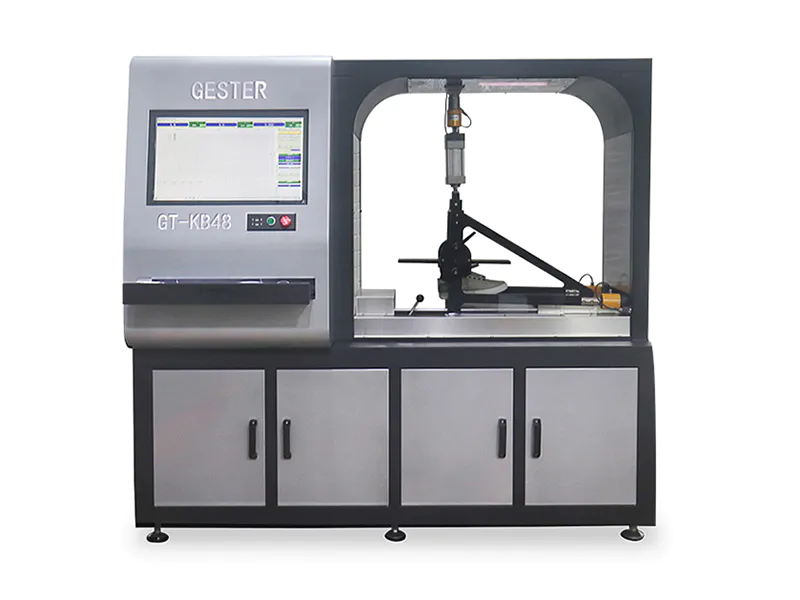

Innovative technology helped us produce a strong, reliable product as textile testing equipment for customers, offer superior quality and dependability to our customers, and scale at a quicker pace.

A wholesaler should have many tensile tester manufacturers based products that could help you if you have a tensile tester manufacturers problem. It is better to treat the problem early rather than have to deal with it later. GESTER International Co.,Limited is your best choice.

GESTER Instruments allocates customer service resources to the platform where their customers are most vocal.

You get a wide variety of security, durability and manageability options across textile testing equipment. Here’s a link of the brand GESTER Instruments.

Innovative technology helped us produce a strong, reliable product as textile testing equipment for customers, offer superior quality and dependability to our customers, and scale at a quicker pace.

A wholesaler should have many tensile tester manufacturers based products that could help you if you have a tensile tester manufacturers problem. It is better to treat the problem early rather than have to deal with it later. GESTER International Co.,Limited is your best choice.

Custom message