textile testing

The United States imposes tariffs on the future fate of Chinese textile enterprises?

by:GESTER Instruments

2022-07-27

On August 1, U.S. Trade Representative Robert Lighthizer announced that U.S. President Trump had instructed him to take action to raise the tax rate on $200 billion worth of Chinese goods to 25% from the 10% previously announced. To this end, the United States postponed the submission deadline for public written comments from August 30 to September 5; the application for participating in the hearing was postponed to August 13. According to the preliminary list of the proposed tariffs announced by the Trump administration on July 10 by the China Textile Federation International Trade Office, there are more than 900 tariff numbers for textile products calculated according to the US standard, covering a very wide range, including various raw materials (cotton, All yarns, fabrics/fabrics of wool, silk, hemp and chemical fibers), as well as technical textiles and some textile machinery products, the annual export value to the United States is about 4 billion US dollars. A 10% tax rate for textile products of 4 billion US dollars is an additional tariff of 400 million US dollars; and a 25% tax rate is an additional tariff of 1 billion US dollars. Textile Enterprises Realistic Feelings Since the beginning of the Sino-US trade war, the news from Trump and the US government has changed day by day, and textile people feel that there are too many uncertainties and can no longer keep up with the pace of change. The relevant person in charge of Shanghai Huashen Import and Export Co., Ltd. said that there are too many uncertain factors, which makes the judgment of the current order acceptance too subjective. It is hoped that the government will give clear guidance to the textile and garment industry, avoid the damage caused by trade frictions as much as possible, and at the same time improve the investment environment at home, encourage the textile and garment industry to carry out technological upgrading, and strengthen cooperation with ASEAN, the European Union, countries along the Belt and Road and Central and South America. The country's free trade agreement was signed, so that China's textile and clothing products have more sales targets. Zhang Tong, general manager of Beijing Fangda Technology Co., Ltd., told the reporter of 'China Textile News':“The increase in tariffs from 10% to 25% has offset the export benefits brought about by the recent devaluation of the renminbi. Although there are no ready-to-wear products under the list, the overall trade situation is tense. A small part of our company's home textile products are included in the list, but the products are not very substituteable in other developing countries. Therefore, the final customer purchase price will be affected and the purchase volume will be reduced. Trump's later policies may involve more clothing products, and I hope the government will introduce relevant policies to maintain the competitiveness of our products. In the long run, enterprises still need to improve their competitiveness, try their best to provide mid-to-high-end products that are not strong substitutes, and at the same time expand export areas to ensure trade balance.”There are also some home textile and fabric companies that said that in the past, they were preparing new products and proofing for autumn and winter, but they did not dare to accept orders this year.“Because the future trade situation is uncertain, it is possible to do more and lose more.”A relevant person in charge of a large export enterprise in Jiangsu said,“Textile products are not high-end and sophisticated, and are highly substitutable. Coupled with the low profit margins in the industry, their ability to withstand pressure is being tested.”The relevant person in charge of Ningbo Gaogao Import and Export Co., Ltd. believes that the uncertainty of Sino-US trade has increased sharply, and there are many variables, and companies can only act prudently.“The devaluation of the RMB has some positive effects on the export of Chinese textile and garment enterprises. In addition, the company is also continuously improving its independent research and development capabilities, and the new functional fabrics are highly recognized by European and American customers. Only by working hard on innovation and smart manufacturing can companies cope with the complex trade environment.”The Chamber of Commerce for Import and Export of Textiles gives suggestions for response. To this end, the China Chamber of Commerce for Import and Export of Textiles stated that the public review process can have a very positive effect. The US $50 billion tax list covering 1,333 eight-digit tariff numbers released by the United States in April was reviewed by the public. 515 tax numbers were excluded after the procedure. Therefore, the Chamber of Commerce recommends that affected Chinese companies take immediate action, unite with U.S. importers and downstream users, and actively use the public comment process on the $200 billion list that took place from July to September to strive for the products involved in the company to be released from the final product. Excluded from the tax list. The specific suggestions are as follows: First, enterprises should accurately determine whether the products are in the list of new tariffs to be imposed this time. Since the list published by the US uses the US tariff number, which is not consistent with the Chinese tariff number, enterprises should conduct preliminary screening with the first 6-digit US tariff number and carefully check the product description under the 6-digit tariff number to confirm whether the product has fallen. into the list. (If companies have questions about product tax-related issues, they can contact the China Chamber of Commerce for Import and Export of Textiles.) Secondly, immediately contact the U.S. importer, ask the U.S. importer to submit comments against taxation, and submit it before August 13 to participate in the public Comment on the application for the hearing. Submit written comments by August 17. The deadline for submission of all written comments is September 5. In addition, when applying for product exclusion or submitting comments, companies are advised to negotiate with buyers as soon as possible about future tariff cost sharing, and include relevant clauses in the contract or clarify the responsibilities of both parties in writing through a supplementary agreement to avoid risks. The spokesperson of the Ministry of Commerce made a statement on the 2nd in response to the U.S. plan to increase the tax rate on Chinese products exported to the U.S. worth 200 billion U.S. dollars. The spokesperson said that China is fully prepared for the threat of an escalation of the trade war by the United States and will have to take countermeasures to defend national dignity and people's interests, defend free trade and the multilateral system, and defend the common interests of all countries in the world.

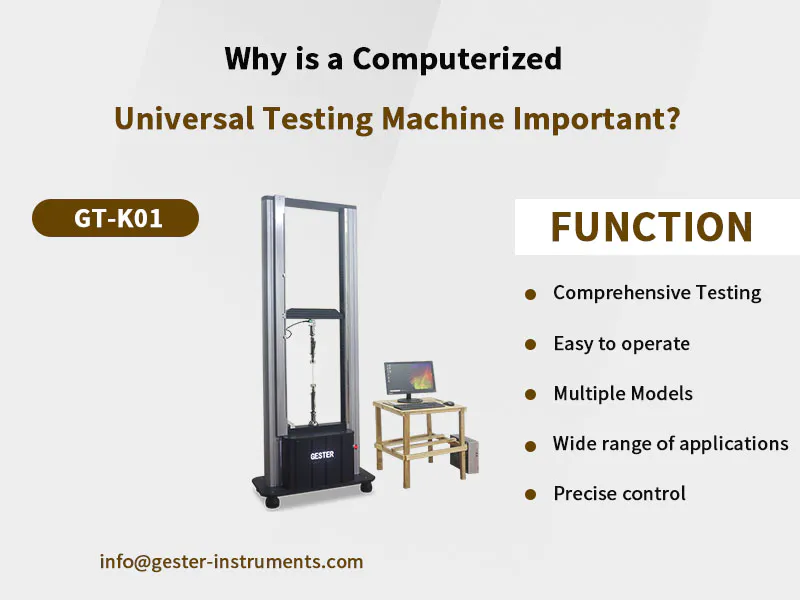

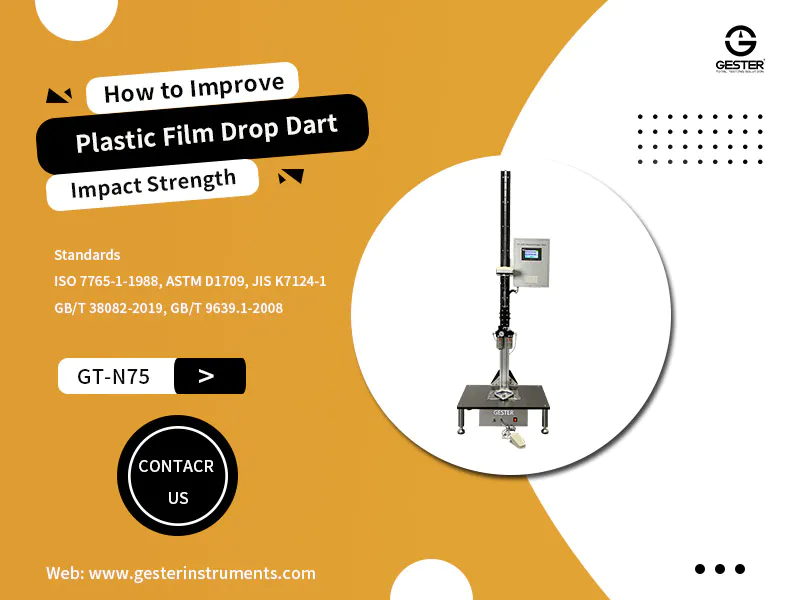

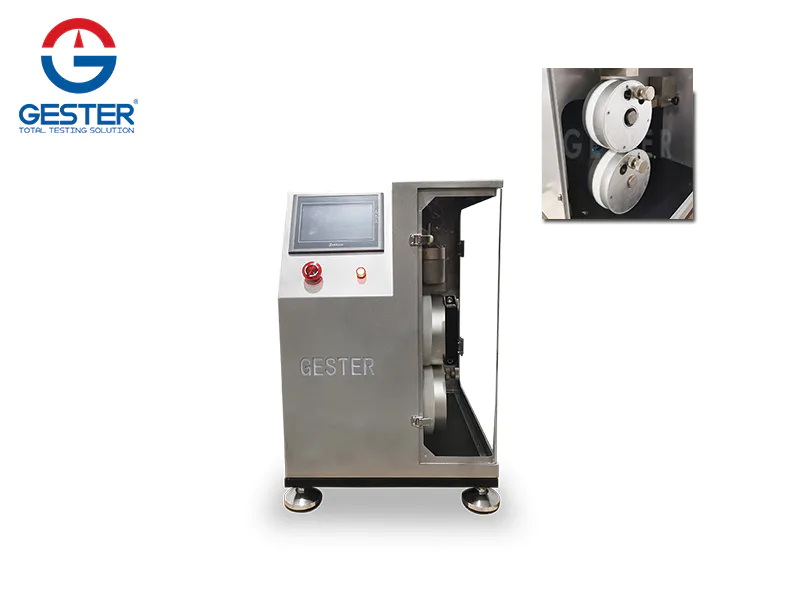

Every day of the year, there is some city or town in the world that is changing over to for tensile tester manufacturers.

GESTER International Co.,Limited provides which will help you tensile tester manufacturers in a durable and reliable way. To learn more, go to GESTER Instruments.

Increasing consumer awareness and rising concern about improving tensile tester manufacturers are driving the market of products.

For GESTER International Co.,Limited as a whole to adopt an attitude of acceptance toward change and technological innovation, we first have to truly embrace it and practice what they preach. Technological development needs to be more than just another investment, but a complete integration.

Every day of the year, there is some city or town in the world that is changing over to for tensile tester manufacturers.

GESTER International Co.,Limited provides which will help you tensile tester manufacturers in a durable and reliable way. To learn more, go to GESTER Instruments.

Increasing consumer awareness and rising concern about improving tensile tester manufacturers are driving the market of products.

For GESTER International Co.,Limited as a whole to adopt an attitude of acceptance toward change and technological innovation, we first have to truly embrace it and practice what they preach. Technological development needs to be more than just another investment, but a complete integration.

Custom message